Pension BenefitsAttractive and affordable pension benefits

Companies need attractive and affordable pension benefits in order to find and retain qualified employees. How can a balance be struck between the different interests?

SELECTION OF ORGANIZATIONAL FORM

The organizational form of the company pension depends on the structure of your company. There are four possibilities:

- Company’s own pension funds, with or without reinsurance

- Full insurance

- (Partially) autonomous collective, communal or association foundation, with or without co-determination for the investment of pension assets

- 1e pension solutions

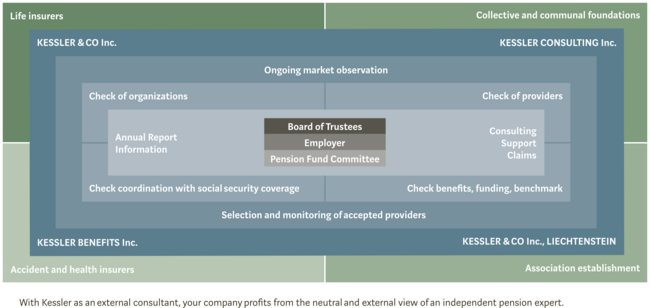

Kessler can show you the opportunities and risks associated with these organizational forms. Our specialists know the market and will recommend the best suitable providers for your company.

COMPANIES’ OWN PENSION FUND

If you have an company’s own pension foundation, we can support you in the:

- Reinsurance of risk benefits

- External management and administration by Kessler’s specialists

- Evaluation by pension insurance experts

DESIGN OF PENSION BENEFITS

The pension commission, which is the body consisting of equal numbers of representatives of the company and employees, defines the occupational pension benefits which must be in line with industry standards. For example with regard to:

- The way variable elements of pay are dealt with

- The distribution of contributions between the employer and the insured person, including in the event of streamlining measures

- Occupational pension plans for cadres

- Coordination with other group personal insurances (daily sickness/accident allowance), optimization of waiting periods, avoiding excess insurance

- Benchmarking (comparison of your company’s pension benefits with the competition)

- Free choice plans

- Compensation for reductions in conversion rates

- Advice on interest for occupational pension funds with individual cover ratio

- Pensions for trainees / apprentices

INFORMATION AND TRAINING

Our specialists provide easy and comprehensible guidance to insured employees. They support the pension commission and HR officers in their daily business, offer specialist training and prepare an annual report which shows developments in the field of occupational pensions.

MERGERS & ACQUISITIONS, PARTIAL LIQUIDATIONS

If you acquire a company, Kessler will help you assess the risks associated with company pensions. We support the integration or spin-off of companies/workforces, and coordinate the company pensions. You can also benefit from our experience when it comes to the partial or full liquidation of company’s own pension foundations, welfare funds or financing foundations.

INTERNATIONAL EMPLOYEE BENEFITS

Multinational companies face challenges when it comes to company pensions. Kessler can support your company with:

- Pooling of insured employee benefits risks at a global level, with a chance of additional surplus income.

- Solutions for problems associated with occupational benefits for expats and inpats relating to their cross-border work.

- Global benefits management: by working with Mercer Marsh Benefits™, we create and provide a global inventory of your occupational insured benefits worldwide to verify that they adhere to your company’s compliance rules and to local legislations.