More than Insurance Broking

We offer the following additional services on a project basis:

ENTREPRISE RISK MANAGEMENT

Enterprise Risk Management is a comprehensive, systematic approach to the successful management of risks. Our modular goodpractice consulting approach meets all the requirements of Executive Committees and Boards of Directors.

BUSINESS RESILIENCE

In advising our clients on how to enhance their business resilience along the whole length of the value chain, we adopt a pragmatic approach tailored to their specific needs. Our advice focuses in particular on business interruption or cyber risks, which need to be recognized, evaluated and monitored.

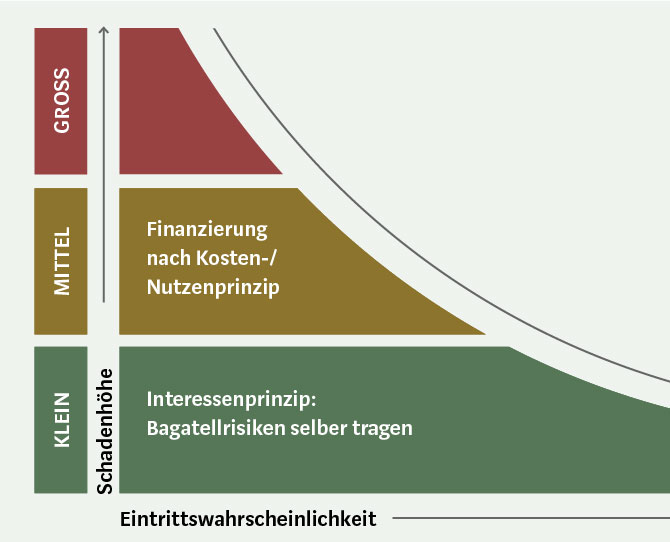

ALTERNATIVE RISK FINANCING AND BUSINESS ANALYTICS

Alternative Risk Financing solutions are important value drivers when it comes to reducing the overall cost of risk. They efficiently combine the transfer of risk and the bearing of its cost by the business itself. We analyze risk costs and offer consulting services and feasibility studies for, among others, structured weather solutions or captives.

HUMAN RESOURCES RISK MANAGEMENT

Personnel risk is a key consideration for any business with employees. Society, the economy and the working world are undergoing rapid change. The consequences are a more flexible labor market, changes in organizational and staff structures, and new challenges for human resources and management. The effects of digitalization, demographic change and psychosocial stress have a major impact on the health, performance and employability of staff, and are directly related to a company’s profitability and success. We analyze the HR risk in companies and offer consulting services for HR processes, control and strategy, and Corporate Health Management (CHM). We also help our clients to optimize their personnel insurance costs.

MERGERS & ACQUISITIONS

From risk identification to risk transfer during corporate acquisitions and sales, we assist you in all insurance matters during the M&A process – whether you are a buyer or a vendor. The services range from transaction preparation to an audit of the target company (insurance due diligence) to transfer of the risk from the company purchase agreement and provision of support with integration or resale. Internationally, our M&A specialist team works closely with our network partner, Marsh.

Are you interested in a collaboration or do you have any questions? Your contact person looks forward to hearing from you.

Urs Sommer

Head Business Development