MANAGEMENT CHALLENGES

Pension plans are currently under enormous pressure stemming from the significant and unique challenges they now face. These are just a few:

LEGAL

- Legislative constraints and changes

- Growing responsibilities

- Pension reform

- Complex regulations

FINANCIAL

- Administrative management expenses

- Wealth management expenses

- Miscellaneous expenses, payments, and fees

- Low/negative interest rates

STRUCTURAL

- Aging demographics

- Corporate restructuring

- Member/retiree cross-subsidization

QUESTIONS AND CONSIDERATIONS

To fully grasp these challenges, the fund’s board must address the proper questions to optimize its fund’s operations:

- Are we up to speed about the legislative environment of our fund?

- Do we have the the best investment advice?

- Are the members of our board adequately trained?

- Are we sufficiently knowledgeable about all stakeholders impacting our fund’s future?

- Is our management adequately organized and resourced to ensure efficiency and stability?

- How can we reduce management overheads?

- What kind of information do active members and retirees actually need?

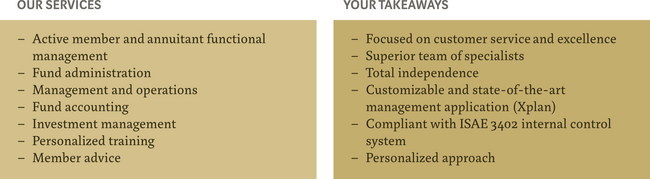

Through its wealth of experience, Kessler Benefits Inc. is a benchmark in Switzerland for pension fund management. We are here to optimally and comprehensively guide you to identify and implement effective solutions that are personalized according to your needs.

MANAGEMENT OUTSOURCING BENEFITS

Based on size considerations, the board would to do well to consider full management outsourcing as an option. Here are its key benefits:

- External delegation of specific and complex tasks, including their inherent risks

- Accessible expert professionals

- Privacy and neutrality

- Improved task organization, process streamlining, internal control system

- Transparent budgeting and costs

- Choosing an external management partner requires in-depth consideration of the following:

- Reputation, experience, independence

- Number, background of employees

- Invoicing method

- Management applications used

- Availability and flexibility

- Remote accessibility options

- Internal control system

We will be happy to discuss these points further with you.

THE IMPACT OF DIGITIZATION

Currently, most pension fund members want to:

- See their pension statement at any time;

- Make their own annuity projections and calculations online; and

- Have clear and precise answers to their pension-related concerns.

Digitization now permits optimizing certain processes, and especially improves services and information provided to members. This is why Kessler Benefits Inc. innovates through leveraging new technologies. We offer our customers state-of-the-art IT tools to improve efficiency both for employers and pension funds alike.

Security issues and the new General Data Protection Regulation (GDPR) are also hot topics, requiring us to fully meet our customers’ expectations by updating methods of personal data collection.

Are you interested in a collaboration or do you have any questions? Your contact person looks forward to hearing from you.

Natalie Koch

Head Kessler Benefits