SERVICES COVERING ALL ASPECTS OF INSURANCE

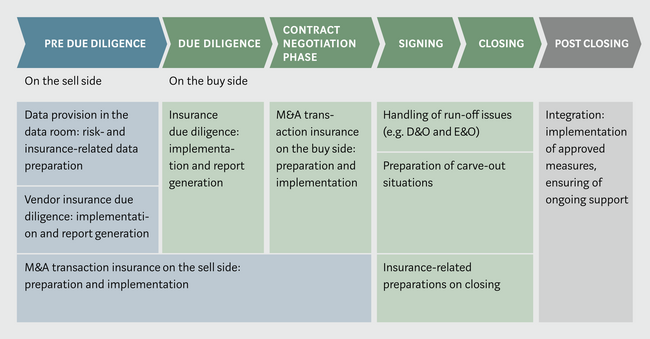

Kessler offers a comprehensive range of services covering all aspects of insurance, such as corporate and personal insurance and pension funds. Particularly with regard to the M&A process, these range from preparing the transaction (providing information and vendor insurance due diligence) and assessing the target company (insurance due diligence) to transferring sales and purchase contract risks (M&A transactional risk insurance, known as Warranty & Indemnity Insurance or Reps & Warranties Insurance) and overseeing integration or resale.

TRANSACTION PREPARATION

In preparation for the scheduled transaction, we compile all relevant insurance data on the sell side in a form that allows you to store and organize it simply, logically and completely in the data room. Besides ensuring that the prospective buyer can find and analyze the data without further ado, this also helps minimize inquiries. Our vendor due diligence report can greatly facilitate the sale of a company, or part of a company.

INSURANCE DUE DILIGENCE

We help you analyze the target company’s current insurance coverage and compile a due diligence report based on the potential integration of the target company into a new group, or on a stand-alone solution.

M&A TRANSACTIONAL RISK INSURANCE

Vendor liability in an M&A transaction is one of the most fundamental issues when negotiating the share and purchase agreement. Transactional risk insurance allows the parties to extend or minimize the liability offered by the vendor while securing the liability reserves to the desired extent of the buyer within the scope of an insurance contract. Whether a buyer or a vendor, transactional risk insurance offers a practical alternative to purchase contract liability and conventional hedging methods such as an escrow account, bank guarantee or similar hedging instruments. If the policyholder is the buyer, any losses suffered from a breach of the sale and purchase agreement or warranty provisions contained therein can be claimed directly from the insurance company. Therefore the vendor must not be held liable. If the policy is concluded by the vendor, support will be given in defending unjustified claims (including the assumption of legal defense costs), and in the form of compensation for justified claims.

KNOWN RISKS

M&A transactions tend to involve known individual risks that can be specifically covered by an insurance solution:

- Tax liability: insurance for the non-occurrence of anticipated tax effects during transactions;

- Litigation buyout / litigation caps: transfer or limitation of liability in the case of pending or imminent legal disputes;

- Environmental liability: insurance for unknown environmental risks or insufficient risk assessment.

Our team of M&A experts works in close collaboration with our Network Partner Marsh, which has a global network of over 200 experts in this field and assists with hundreds of M&A transactions each year. This allows us to carry out cross-border transactions in virtually all jurisdictions around the world, and provide expert and timely assistance.