ClaimsExcellence

In the event of a major claim, the company affected must often fight to receive the necessary insurance benefits. At Kessler, our specialists do this for you. Companies that are not (yet) our customers can, of course, benefit from this support too.

IF THE INSURER DOES NOT WANT TO PAY OUT

Companies in all sectors are complaining more than ever that their insurers are delaying delivery of the necessary benefits following an insured event. These owed payments often have to be laboriously negotiated through legal proceedings. This results in the loss of valuable time, meaning that in the event of a major claim, this can delay the resumption of business activities, for example. The insurer carries out increasingly critical and hence also increasingly lengthy checks to assess whether it needs to provide insurance benefits or can withhold at least some of them. There are four main reasons for this approach:

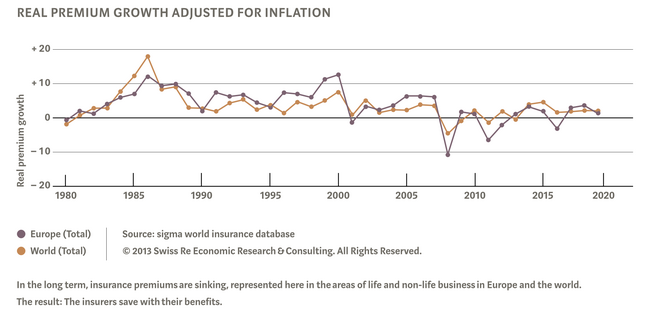

- The insurer is under extreme cost pressure, caused by falling premiums and greater competition on the saturated market.

- The highly-fluctuating financial markets hamper capital investment for insurers, reducing their earnings.

- The legal and technical conditions that the insurers are subject to are becoming increasingly demanding.

- Due to globalization and regulation, many companies have increasingly complex structures, products and sales channels etc., which increases their claims against the insurer.

The longer it takes before the insurance benefits are delivered in the event of a major claim, the greater the threat to the existence of the company in question. Payments often need to be pre-financed in order to limit business downtime and prevent the business from failing completely. This situation especially overburdens companies that have previously opted out of the insurance broker’s services or where the insurance broker is not able to manage such cases. This is where Kessler comes in.

EVEN IF YOU ARE NOT (YET) OUR CUSTOMER

Our customers benefit from the know-how of the specialists at Kessler, who represent their interests vis-à-vis the insurer and deal with the claim settlement. Companies who are not (yet) customers of Kessler can of course also make use of these services. Our services include:

- No-obligation analysis of the liability and coverage situation

- Creation of a solution concept

- Conducting of negotiations with the insurer

- Financing of legal proceedings if necessary

In the event of large, complex claims, the evaluation and definition of insurance benefits as well as the enforcement of said benefits upon the insurer are particularly challenging. This is one of Kessler’s core competencies. Our experience in the area of special risks and liability is extremely important in this respect.

The emotional dimension of an insured event should not be neglected, as the employees, members of the company management team and the administrative boards are also always personally involved. The situation is especially delicate if people have come to harm.

The decision makers of companies affected don’t just rely on their personal contacts at Kessler when faced with drastic situations.

ACT FAST

In the event of a major loss, fast, well-considered action is required. The better we know your company, the more effectively we can intervene and support you, and the stronger our joint position is in relation to the insurer. So contact us as soon as possible. It’ll be worth it.

Êtes-vous intéressé-e par une collaboration? Votre interlocuteur se tient à votre disposition pour toute question.

Helmut Studer

General Counsel