WHEN TRADITIONAL INSURANCE IS NOT ENOUGH

An ARF solution is the answer for those who find traditional insurance solutions inadequate and need a tailor-made risk financing strategy that optimizes their cash flow. Here are some practical examples:

Traditional portfolio approaches give companies too little credit for their (good) claims history. Businesses also might find that their specific risk situation will be inadequately covered by standardized insurance solutions. They are often limited as to what their insurability actually warrants. ARF solutions also make sense whenever lacking transparency, fluctuating premiums as well as restrictions on insurance cover and capacity make it difficult for businesses to efficiently plan their insurance requirements. ARF solutions add value for businesses not least in the following ways:

- Optimized cash flow

- Reduced total cost of risk

- Balance sheet and income protection

- Insurable risks managed with greater efficiency

- Positive contribution toward implementing value-oriented risk management

SPECIALIZED FINANCIAL SOLUTIONS

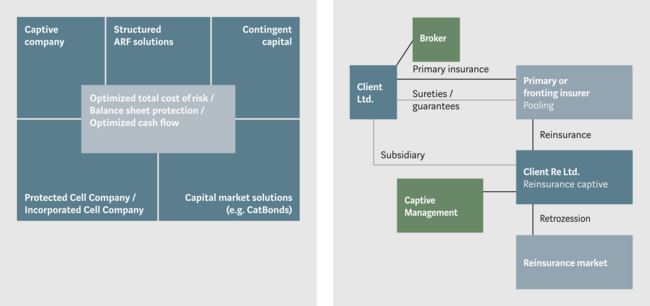

In order to comprehensively cover specialized risks, companies have a variety of ARF solutions to choose from, based both on insurance and on the capital markets. Among the latter are cat bonds or contingent capital solutions. Most frequently, though, structured ARF solutions or what are termed «captive arrangements» are used. These solutions generally involve the company bearing a large part of the risk itself. It is advantageous, however, not to determine the share of risk to be borne by the company itself in isolation, but to adapt it to the company’s risk tolerance, i.e. its ability to bear risk, and its risk appetite, i.e. its inclination to do so.

EXPERTISE IN ARF SOLUTIONS

Kessler Consulting has many years of experience and in-depth specialist and market knowledge in relation to Alternative Risk Financing. Our advisory services focus on:

- Analysis of the risk-related costs (premiums, losses, expenditure on loss reduction, administration costs) with the objective to achieve savings and to improve the structure and scope of cover

- Elaborate alternative risk financing concepts

- Actuarial studies inclusive solvency calculations

- Regulatory and compliance management

ADVICE ON CAPTIVES

For many companies, setting up their own (re)insurance company (a captive) to (re)insure some of their risks is a reasonable decision to take. Protected cell companies (PCCs) are designed in much the same way and for the same purpose. The main differences are in the companies’ ownership structures, whose main effects are on autonomy in decision-making. Kessler Consulting offers the following captive related services:

- Evaluating the value added by the captive or PCC, inclusive strategic review

- Domicile reviews

- Establishing and licensing captive structures

- Redomiciling, transferring portfolios and evaluating and implementing exit strategies

- Captive benchmarking services

FEASIBILITY STUDIES

Kessler Consulting evaluates ARF solutions by means of so-called feasibility studies, for example of captives or structured weather solutions. Such studies provide clients with a basis, tried and tested in practice, for decisions on how to put such solutions to work.

Kessler Consulting takes care of the management of existing or newly-established captive solutions. Its services also include market placements and ongoing support for ARF solutions.

Are you interested in a collaboration or do you have any questions? Your contact person looks forward to hearing from you.

Simon Künzler

Head Risk Consulting