INSURANCE PORTFOLIO/RISKS

We recommend updating the key financial and temporal aspects of a BI insurance policy on a regular basis. The world of business is dynamic. This means that the potential loss of earnings or the amount of time needed to get a site up and running again is subject to significant and rapid changes. Processes, products and services are constantly evolving, while dependencies in the supply chain are increasing.

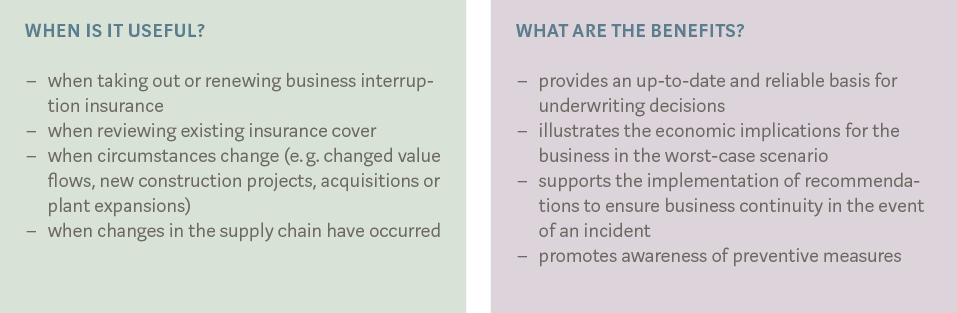

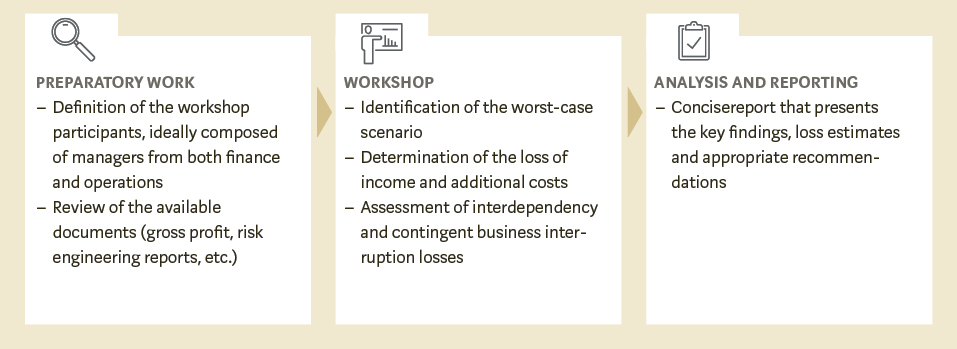

As part of the BI analysis, the potential financial consequences of an insured event (e. g. a major fire or a natural disaster) are examined in detail. We work closely with you to develop scenarios (including the worst-case scenario) and quantify the potential loss of earnings and recovery time. We also estimate the additional costs that might be incurred in the event of such an unplanned incident. Within a specified sub-limit, a business interruption insurance also covers losses that arise if the company is unable to fully or partially continue operations due to property damage at external businesses, such as suppliers or customers. This loss dimension is also addressed as part of the project.

The findings will give you a reliable basis for concluding a business interruption insurance policy that meets your exact needs. The development of scenarios – especially a worst-case scenario – also provides the company with valuable information on the basis of which measures that go beyond the scope of the insurance can be taken to increase your company’s resilience.

DIFFERENCE BETWEEN BI ANALYSIS AND RISK ENGINEERING REPORT

Although risk engineering often comes in hybrid forms, it is primarily used to analyze technical and structural conditions with the aim of identifying potential risks and developing technical or organizational preventive and intervention measures. In contrast, the primary objective of BI analysis is to determine the economic losses in the event of business interruption caused by an insured event.

INSURANCE DUE DILIGENCE

We help you analyze the target company’s current insurance coverage and compile a due diligence report based on the potential integration of the target company into a new group, or on a stand-alone solution.

We advise you

Our team has in-depth knowledge and extensive experience in the field of BI analysis and will be pleased to assist you with your requirements. We look forward to conducting an analysis with you.